While you do not have to add every optional type of auto insurance policy to your policy, the much more protections you add, the extra protection you'll have on the road. You can function with our professionals to get the best mix of insurance coverages that make sense for you as well as your family.

is the cheapest complete insurance coverage business nationally, yet if you're looking trying to find cost savings you must compare the most affordable in your state. Complete protection is extra costly than liability-only insurance coverage as it will pay for repair work to your auto from an at-fault accident, climate damages, burglary or various other circumstances - dui. If you're seeking a firm that is cheap however likewise reputable, it makes sense to consider the best full coverage business for solution track record.

Contrast Automobile Insurance Fees, Guarantee you are getting the best price for your cars and truck insurance coverage.

Just How Much is Complete Protection Car Insurance Coverage in Your State? Automobile insurance coverage is regulated by the states, so the most inexpensive firms for full insurance coverage at a nationwide level may not always be the least expensive company in your state. Money, Nerd located that, the cheapest firm for full protection country wide, is additionally more than likely to be the least expensive typically in your state - cheaper auto insurance.

It was the most budget friendly for our example vehicle driver in 38 states. Surf to your state listed below to find out more about the most affordable complete coverage policies where you live.

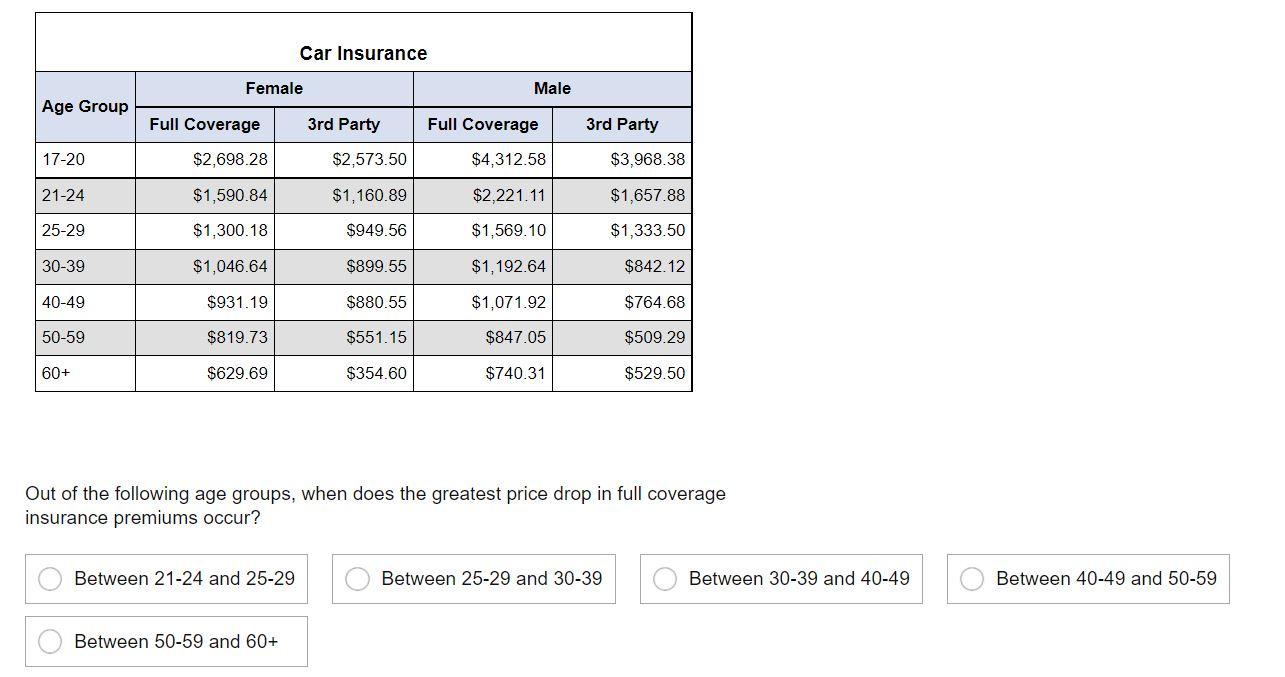

Crashes and also tickets on your driving document could increase the cost of complete protection vehicle insurance policy in your state, decreasing your possibilities of getting inexpensive auto insurance coverage rates. When contrasting the typical annual premium for complete insurance coverage insurance, the boost with a ticket is $759 each year. GEICO's average complete insurance coverage rate of $1,265 after a speeding ticket is the most budget friendly for the majority of chauffeurs when compared to other business.

An Unbiased View of When Is The Best Time To Drop Full Coverage Car Insurance?

insured car insurance automobile cheaper car

insured car insurance automobile cheaper car

Chauffeurs with GEICO who have a history of infractions can get back at much more cost savings with its discount rates for seat belt usage, air bags and credit history for completing a protective driving training course. Scroll for more USAA can be found in as the lowest-cost business for these coverages, costing approximately $939 per year.

If you are associated with a crash, it could affect your chances of getting economical complete insurance coverage vehicle insurance policy prices. cheap car. While not all mishaps and cases will certainly elevate your rates, you need to anticipate prices to change if you are entailed in a mishap. When contrasting rates for the same 50 companies, we located that the ordinary rate increase is $1,130 even more per year.

With a mishap on Great post to read their record, chauffeurs guaranteed by State Ranch can anticipate to pay a standard of $320 even more for complete insurance coverage insurance than if they had a clean driving document. Get even more financial savings from State Ranch by benefiting from price cuts for air bags, anti-theft tools or finishing a protective driving program. vehicle insurance.

USAA stays the most affordable alternative though just existing and former military households will be eligible to buy it. How much rates alter when changing responsibility. limits will differ from business to business. Even if you're attempting to conserve, on your insurance policy bill, you must still purchase a suitable amount of liability insurance.

The Ideal Full Insurance Coverage Auto Insurance Provider, You should consider greater than just rates when buying a complete insurance coverage automobile insurance plan. You'll want a company that combines cost savings with exceptional client service and also claims processes. And you'll want it to be financially secure to ensure that you recognize your insurance claims will certainly be paid.

Various other coverages might be included completely insurance coverage automobile insurance coverage, such as injury protection (PIP), medical repayments, rental automobile insurance coverage and also roadside support. These additional protections are thought about optional as well as can be included in a quote for cost-comparison purposes. Just how to Buy the Least Expensive Full Insurance Coverage Policy, Among the very best ways to get inexpensive full coverage auto insurance coverage is by shopping with a number of automobile insurer (auto).

Unknown Facts About Liability Only Vs Full Coverages - Direct Auto Insurance

Recognizing your present coverages can help you find the ideal offer for full insurance coverage. 2Quote the same insurance coverages, Whether you're comparing 2 or 5 different vehicle insurance provider, be constant with the insurance coverages you're making use of to compare. Make use of the exact same liability limitations and extensive and also accident deductibles to make an accurate comparison to find the best affordable complete coverage automobile insurance coverage (cheaper car).

Mishap forgiveness, void insurance and also rental auto insurance coverage are simply a few of the alternatives available. Optional coverages differ by firm and might not be offered to all customers. Cash, Nerd has examined rates across the board to assist you find the finest as well as most affordable full coverage auto insurance policy in your state.

Your private circumstance and also individualized requirements are the most effective determining elements of just how much you'll pay for complete insurance coverage car insurance policy (insurance). These suggestions and steps can offer you a big head beginning in finding your best choice. Usual Questions Regarding Full Protection Auto Insurance policy, The following are several of the most constant questions chauffeurs have concerning getting full insurance coverage auto insurance coverage.

But it typically describes policies that add comprehensive and crash insurance to the minimum responsibility insurance policy demands mandated by your state. Comprehensive and crash insurance secures you versus the cost of problems to your automobile, on and off the roadway. Obligation insurance protects you versus the cost of problems to others when you're at mistake.

The average auto insurance expense for full insurance coverage in the United States is $1,150 annually, or concerning $97 monthly. No insurance plan can cover you and also your cars and truck in every scenario. However a 'complete coverage automobile insurance coverage' policy covers you in a lot of them. Full coverage insurance coverage is shorthand for automobile insurance plan That cover not only your obligation but damage to your cars and truck - low cost.

A full coverage policy depending upon state legislations might likewise cover uninsured motorist insurance coverage and a clinical insurance coverage of injury protection or clinical repayments. A normal full protection insurance plan will certainly not cover you as well as your automobile in every situation. It has exemptions to specific events. IN THIS ARTICLEWhat is complete coverage cars and truck insurance? There is no such thing as a "full insurance coverage" insurance plan; it is merely a term that describes a collection of insurance policy coverages that not only consists of responsibility coverage yet accident and thorough also.

Minimum Auto Insurance Requirements - Department Of ... Can Be Fun For Everyone

What is taken into consideration full insurance coverage insurance to one vehicle driver may not be the very same as also another chauffeur in the same house. Ideally, complete coverage implies you have insurance in the kinds and quantities that are suitable for your earnings, properties and also risk profile.

/female-motorist-involved-in-car-accident-calling-insurance-company-or-recovery-service-1156653034-d6de18eb46e04b3a873cc9b69ae9f60a.jpg) auto insurance low cost cars auto insurance

auto insurance low cost cars auto insurance

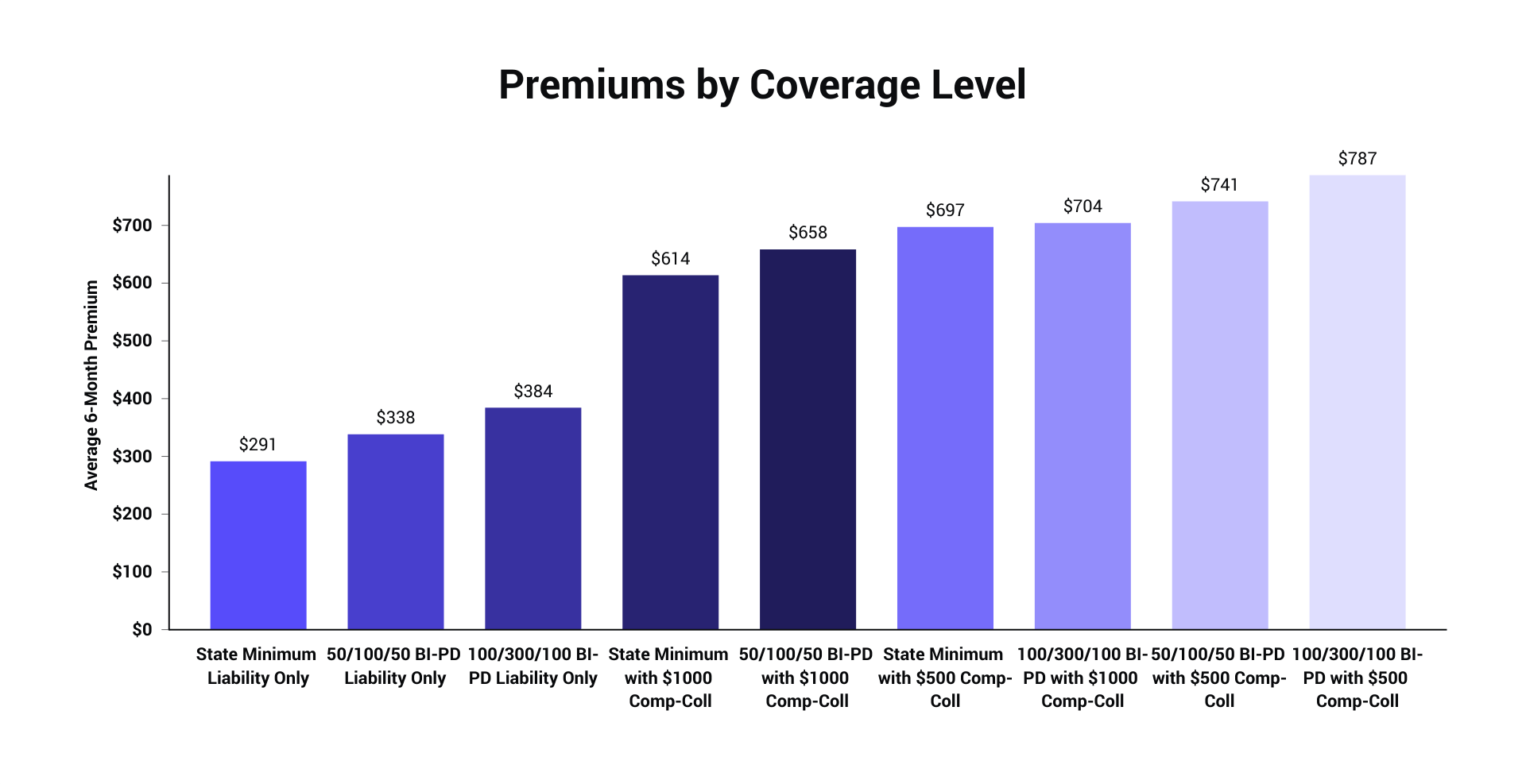

Rates also vary by hundreds or perhaps countless bucks from business to business. That's why we constantly suggest, as your very first step to saving cash, that you contrast quotes. Here's a state-by-state comparison of the typical annual cost of the adhering to protection degrees: State-mandated minimal obligation, or, simplistic coverage required to lawfully drive a vehicle, Full coverage responsibility of $100,000 per person harmed in a mishap you cause, up to $300,000 per mishap, and also $100,000 for property damages you trigger (100/300/100), with a $500 insurance deductible for extensive and also accident, You'll see exactly how much full coverage auto insurance coverage expenses monthly, as well as annually.

cheap car insurance insure credit cheap car insurance

cheap car insurance insure credit cheap car insurance

The ordinary annual price for complete insurance coverage with higher liability limits of 100/300/100 is around $1,150 more than a bare minimum policy. If you select lower liability limitations, such as 50/100/50, you can save yet still have suitable defense - suvs. The average monthly cost to enhance protection from state minimum to complete protection (with 100/300/100 restrictions) has to do with $97, but in some states it's a lot less, in others you'll pay even more.

Your vehicle, up to its reasonable market price, minus your deductible, if you are at fault or the various other driver does not have insurance policy or if it is damaged by an all-natural disaster or swiped (compensation and also accident)Your injuries and also of your travelers, if you are struck by an uninsured vehicle driver, approximately the restrictions of your without insurance motorist policy (without insurance motorist or UM) - cheapest.

In fact, complete coverage car insurance plan have exemptions to certain incidents. Each complete cover insurance plan will have a list of exemptions, implying things it will certainly not cover. Racing or various other rate contests, Off-road usage, Usage in a car-sharing program, Disasters such as battle or nuclear contamination, Damage or confiscation by government or civil authorities, Using your lorry for livery or shipment purposes; organization usage, Deliberate damage, Cold, Deterioration, Mechanical failure (often an optional protection)Tire damage, Items swiped from the cars and truck (those may be covered by your house owners or occupants plan, if you have one)A rental auto while your own is being repaired (an optional protection)Electronics that aren't completely connected, Customized components and also devices (some small quantity may be specified in the plan, yet you can typically include a biker for greater amounts)Do I need complete protection auto insurance? You're needed to have obligation insurance policy or a few other proof of economic duty in every state.

You, as an auto owner, are on the hook personally for any kind of injury or building damage beyond the limits you chose - cheaper. Your insurance policy business will not pay greater than your limit. Responsibility coverage will not pay to fix or replace your vehicle. If you owe money on your car, your lending institution will call for that you acquire crash and also extensive protection to shield its investment.

The Buzz on Full Coverage Car Insurance Policies - Usaa

Right here are some regulations of thumb on insuring any type of car: When the cars and truck is brand-new as well as funded, you have to have complete insurance coverage. Keep your deductible workable. When the car is paid off, raise your deductible to match your readily available cost savings. (Higher deductibles assist lower your costs)When you get to a factor monetarily where you can change your vehicle without the assistance of insurance, seriously take into consideration dropping extensive and crash.

It'll likewise suggest deductible limits or if you require protection for uninsured driver insurance coverage, medpay/PIP, as well as umbrella insurance policy. The best method to discover the cheapest full coverage car insurance policy is to shop your coverage with various insurers. car insurance.

Below are a couple of pointers to comply with when purchasing cheap full protection car insurance policy: Make certain you are constant when shopping your liability restrictions - cheap auto insurance. If you choose in bodily injury obligation per person, in physical injury liability per crash as well as in property damages responsibility per mishap, always go shopping the very same protection degrees with various other insurance companies.

insured car cheapest auto insurance cheaper cars auto

insured car cheapest auto insurance cheaper cars auto

These insurance coverages belong to a complete insurance coverage bundle, so a premium quote will certainly be required for these insurance coverages also. Both accident as well as comprehensive featured a deductible, so make sure always to choose the exact same insurance deductible when purchasing coverage - laws. Selecting a higher deductible will certainly press your costs lower, while a reduced deductible will lead to a higher premium.

There are other protections that assist make up a complete insurance coverage bundle - cheapest auto insurance. These coverages vary yet can include: Uninsured/underinsured vehicle driver insurance coverage, Injury protection, Rental compensation coverage, Towing, Gap insurance coverage, If you need any of these extra coverages, always pick the exact same protection levels and also deductibles (if they use), so you are contrasting apples to apples when buying a brand-new plan.